Non-Income Contributors Need Disability Insurance Too

Cover those who keep the home and family running smoothly every day.

If you’re a stay-at-home parent or caregiver, have you thought about what would happen if you became disabled? Managing a home and family is an important role—one that could present a real financial hardship if you were no longer able to do it.

Discounted Income Protection Plans

Our individual plans provide coverage in the event you’re too sick or injured to work or to care for your family. Own and keep your policy, even if you change jobs.

The Economic Value of Your Contributions

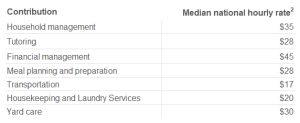

You spend countless hours running your household. Have you thought about the monetary value of those tasks?

Salary.com estimates the equivalent annual salary for homemakers to be $184, 820.3 Could your family cover those costs?

Disability insurance for Non-Income Contributors

Stay-at-home parents traditionally have not been eligible for Long Term Disability (LTD) benefits. Our partner, Ameritas, is one of the few companies that offers a lump sum disability insurance plan for stay-at-home parents and homemakers.

The DInamic Fundamental LTD plan from Ameritas pays a lump sum benefit of $25,000-$50,000 if a homemaker becomes totally disabled due to sickness or injury and the disability is expected to last at least one year.4

Without disability insurance, the costs to cover household responsibilities could devastate a family’s finances. LTD insurance from Ameritas can help provide peace of mind and cash benefits that could help keep your family on track in the event you can’t for a while. Speak with an LTD Advisor to learn more.

1 “Almost 1 in 5 stay-at-home parents in the U.S. are dads,” Pew Research Center, www.pewresearch.org, August 2023.

2,3 “How Much is a Mom Really Worth? The Amount May Surprise You,” Salary.com, 2023, https://www.salary.com/articles/how-much-is-a-mom-really-worth-the-amount-may-surprise-you. These are average costs and will vary by location.

4 Not available in CA, FL, MD, NJ, NM, UT and VT. The homemaker must have little to no income (working less than 30 hours a week outside the home). Minimum household income is $36,000 per year (households under $50,000 a year qualify for the $25,000 minimum benefit). Benefit amount is one half of the household income, rounded to the next highest $5,000, up to $50,000.